As the single-family rental (SFR) market becomes more competitive, every investor must clearly define their positioning. The Locate Alpha team looked at 4,000 active listings by national SFR (single family rental) operators around the country, active in late February 2022. We took Invitation Homes and American Homes for Rent as examples, examining their listings in all national markets.

Category: Market Analysis

The Gas Station Effect

Some things, when near to a home, can have a negative effect on value. What about gas station? The fumes, traffic and noise would probably make a home less desirable if the home is too close. But how much, and can the data show this?

What Are the Odds a House Will Go On the Market?

We developed a model to determine whether a house will sell in the near future. Your odds of getting a sale can be 3-7 times higher if you target homes with a high probability of sale.

What Is Driving Rental Growth?

Locate Alpha is full of information to describe investment locations. But what made us choose the variables that we did? How do we know — and prove — that what we put on the scorecard to describe a neighborhood is relevant information?

Suburban Single-Family Rents up Almost 20%

Average home valuations in the Dallas-Fort Worth area were up nearly 20% from mid-2020 to mid-2021. But have rents increased?

Under-Inflated Second Home Markets: Do They Exist?

Prices are rising around the country, and the same is true for vacation homes. What we did not expect to see that was that even the second-tier of lesser-known vacation spots have also shot up in price, leaving few areas untouched by rapid price growth. Where are these under-inflated markets?

Wall Street Buyers: Are They Pushing You Out of the Market?

There’s been a lot of media coverage lately about booming housing prices. Some are pointing to big institutional buyers, like REITs, as a source of the problem. We tend to disagree. Here’s why.

Identifying Underdevelopment Near Downtown Dallas

For the last several years, we have been following the planning of the I-345 corridor re-development near downtown Dallas. The idea, which has been studied since 2014, revolves around dismantling a freeway that has bisected the city since the early 1970s and contributed to under-performance in nearby areas. In a conversation with Patrick Kennedy, one of the masterminds and proponents of the initiative, I thought about whether there is an obvious way to calculate which specific areas are most affected by under-development and are best placed for revival if the I-345 freeway is dismantled.

63,000 Homes in the Dallas-Fort Worth Area Suffered the Worst of the Cold Snap

Our research revealed that it was an equal-opportunity power outage. Hardest-hit, however, were 63,000 households in areas that lacked both power and a backup sources of heat. The data suggest high-income areas did not experience fewer outages in this event, than other areas.

Summer: Sizzling Rental Season?

For a real estate investor trying to fill a vacancy, it is not uncommon to find big differences between summer and winter.

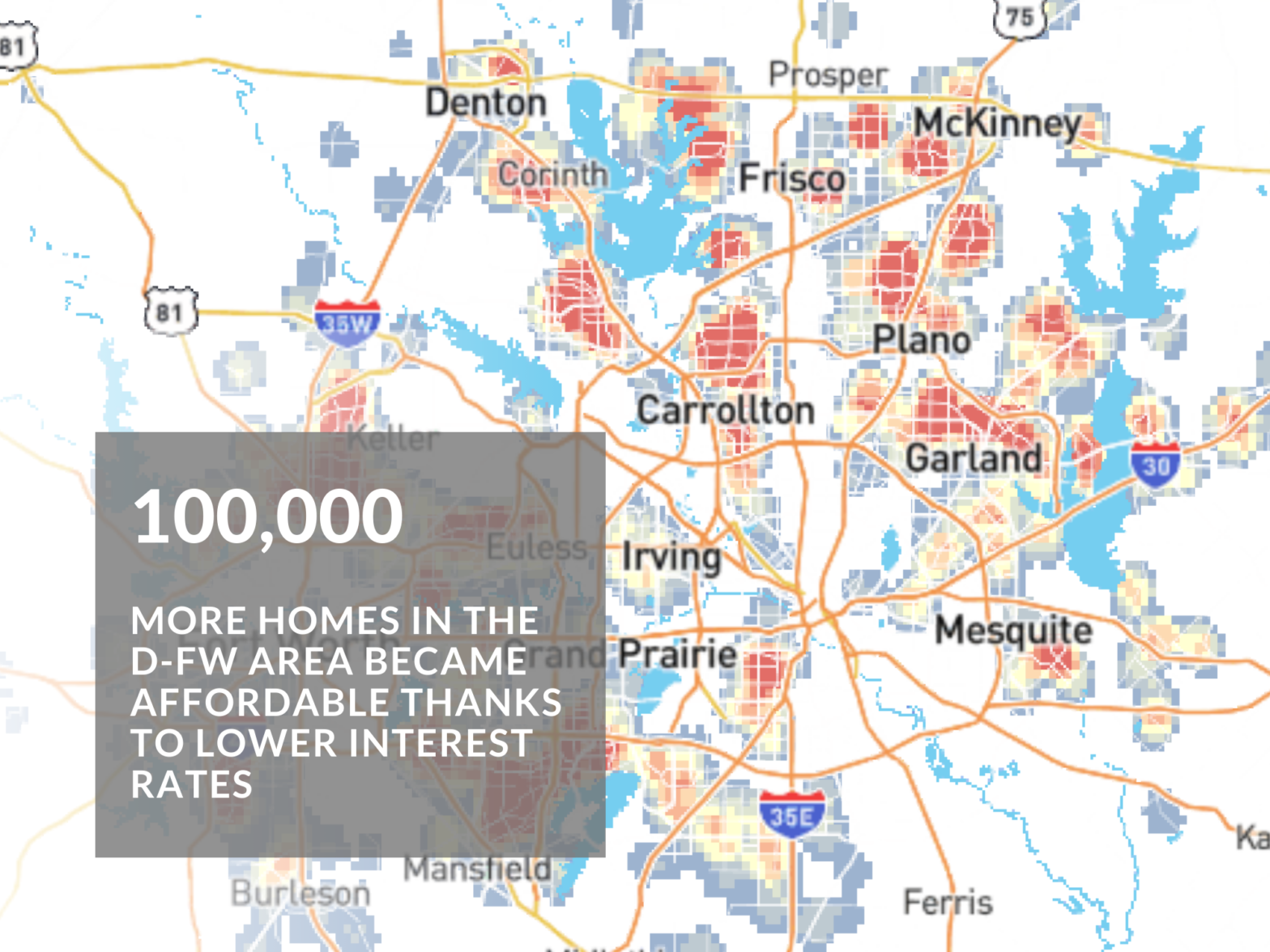

100,000 More Dallas-Fort Worth Homes Just Became Affordable

Dallas-Fort Worth housing market boosted by record low mortgage rates.

Shade in a Texas Summer…is It Worth a Premium?

Heat, sunshine, and the housing market.